nebraska vehicle tax calculator

Registration fees for all passenger and leased vehicles are. Nebraska vehicle tax calculator.

Cost Of Registering A Car In Wisconsin Is Going Up Title Fees Too

Some states provide official vehicle registration fee calculators while others provide lists of their tax tag and title fees.

. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. DMV fees are about 765 on a 39750 vehicle based on a percentage of the vehicles value. The exception is apportioned vehicles vehicles over 26000 pounds that cross state lines which are registered through the.

The MSRP on a vehicle is set by the manufacturer and can never be changed. If you are not a Nebraskagov subscriber sign up. 3320 cents per gallon of regular gasoline and diesel.

January 31 2022 by Molly. Registrations in the State of Nebraska are issued at the Motor Vehicle Office in the county where the applicant resides. Nebraska vehicle tax calculator.

Before that citizens paid a state property tax levied annually at registration time. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Nebraska local counties cities and special taxation districts. These fees are separate from.

2000 century 2100 boat for sale. It is 15 to register your car in Nebraska located in the United. Once the MSRP of the vehicle is established a Base Tax set in Nebraska motor vehicle statutes is assigned to the specific MSRP range and motor vehicle tax is then assessed.

The documentation fee is set by the dealer but is not negotiable so clarify upfront what the dealer charges. Questions regarding Vehicle Registration may be addressed by email or by phone at 402 471-3918. Nebraska charges a motor vehicle tax and a motor vehicle fee that is based upon the value and weight of the vehicle being registered so the charges will vary.

161 average effective rate. Sales tax on cars is 5 in Nebraska. Here are five additional taxes and fees that go along with a vehicle purchase.

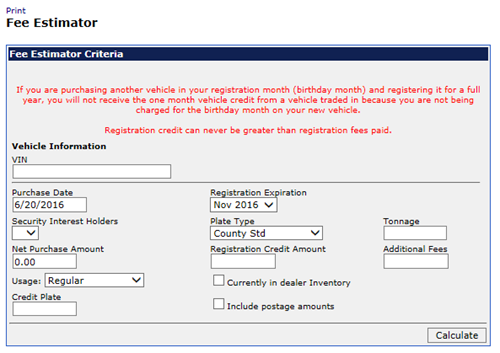

This means that depending on your location within Nebraska the total tax you pay can be significantly higher than the 55 state sales tax. Nebraska vehicle tax calculator. You must have the vehicles VIN vehicle identification number in order to get an estimate.

The documentation fee is set by the dealer but is not negotiable so clarify upfront what the dealer charges. The tax commissioner assigned a value. Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc.

Money from this sales tax goes towards a whole host of state-funded projects and programs. A 100 fee is charged for each successful Nebraska Title Lien and Registration Record Search. Your purchase will be charged to your Nebraskagov subscriber account.

In Nebraska the sale of cars is subject to a sales tax like for most other states. The nebraska income tax calculator is designed to provide a salary example with. You can estimate your taxes using Nebraskas tax estimator.

Nebraska Sales Tax on Cars. The motor vehicle tax and motor vehicle fee replaced the property tax levied on motor vehicles beginning Jan. If you live in the city limits of Bellevue Papillion La Vista Gretna or Springfield you need to select your city to get the correct sales tax computation.

Nebraska Documentation Fees. These sales taxes fund a vast range of projects and programs throughout the state. The car or motor vehicle tax in Nebraska can be overwhelming since they are actually several taxes rolled together to pay for one very expensive little sticker on your license plate.

Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0824 on top of the state tax. If you are registering a motorboat contact the Nebraska Game and Parks Commission. Registering a recently-purchased vehicle will involve paying state and local sales tax in addition to registration and possible plate fees.

The percentage of the Base Tax applied is reduced as the vehicle ages. The Nebraska sales tax on cars is 5. The motor vehicle tax is the only deductible item for nebraska.

The state of NE like most other states has a sales tax on car purchases. In 2012 Nebraska cut income tax rates across the board and adjusted its tax brackets in an effort to make the system more equitable. Find your state below to determine the total cost of your new car including the car tax.

This service is intended for qualified business professional use only to view vehicle title lien and registration information. The nebraska income tax calculator is designed to provide a salary example with salary deductions made in nebraska. To register an apportioned vehicle vehicles over 26000 pounds that cross state lines contact the Department of Motor Vehicles Motor Carrier Services.

Nebraskas motor vehicle tax and fee system was implemented in 1998. 3320 cents per gallon of regular gasoline and diesel. Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator.

If you are unsure call any local car dealership and ask for the tax rate. Average DMV fees in Nebraska on a new-car purchase add up to 67 1 which includes the title registration and plate fees shown above. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less.

You can obtain an online vehicle quote using the Nebraska DMV website. Under the pre-1998 system motor vehicles were assigned a value by the Tax Commissioner based on average sales price for vehicles of that make age and model and the local property taxing units of government merely assessed the rate against that. View the Nebraska state fee estimator to verify your registration cost and use our DMV Override to adjust the calculator.

How Does Nebraska Calculate Motor Vehicle Tax.

Car Tax By State Usa Manual Car Sales Tax Calculator

What S The Car Sales Tax In Each State Find The Best Car Price

Calculate Your Transfer Fee Credit Iowa Tax And Tags

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Dmv Fees By State Usa Manual Car Registration Calculator

Taxes And Spending In Nebraska

Car Title Vs Registration What S The Difference Rategenius

Dmv Fees By State Usa Manual Car Registration Calculator

Car Depreciation How Much It Costs You Carfax

Buying Or Selling A Vehicle Douglas County Government

The States With The Lowest Car Tax The Motley Fool

Class 3 Licence Alberta Cost And Steps Truck Driver Class Driving Courses

Taxes And Spending In Nebraska

Dmv Fees By State Usa Manual Car Registration Calculator

California Vehicle Sales Tax Fees Calculator

Can You Register A Car Without Insurance

Car Title Vs Registration What S The Difference Rategenius

Which U S States Charge Property Taxes For Cars Mansion Global